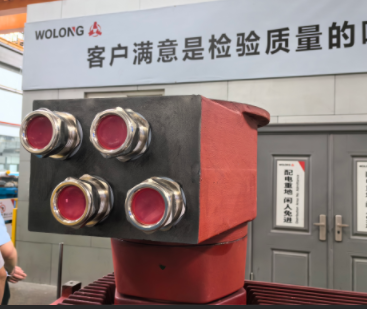

[Wolong, China] – The global industrial motor manufacturing sector, a vital component of automated production and heavy machinery, is grappling with unprecedented cost pressures following a dramatic and sustained surge in global copper prices. This spike is significantly impacting manufacturers, particularly those specializing in the widely utilized three-phase induction AC motor, where copper constitutes a substantial portion of the material cost.

The Material Reality: Copper’s Crucial Role

Three-phase induction AC motors are the workhorses of industry, powering everything from pumps and fans to conveyors and compressors. Their design relies heavily on copper for the windings in both the stator and rotor, making them highly susceptible to volatility in the copper market. Copper’s excellent electrical conductivity is non-negotiable for achieving the motors’ required efficiency and performance.

Over the past few months, the price of copper has soared to near-record highs, driven by a complex mix of factors including robust global demand, supply chain disruptions, and increased investor speculation fueled by the green energy transition—as copper is a key component in electric vehicles and renewable energy infrastructure.

“For manufacturers of industrial motors, especially high-volume three-phase units(high voltage 3 phase ac motor), the cost of copper is arguably the single most critical variable component,” “A 30-40% increase in copper costs translates almost directly into a proportional increase in the motor’s Bill of Materials (BOM).”

Industry-Wide Ripple Effects

The immediate and most visible effect is the necessity for manufacturers to implement rapid and substantial price adjustments. Foreign trade operators are currently facing the arduous task of communicating these sudden price revisions to international buyers, who are accustomed to more stable pricing models. This not only strains buyer-supplier relationships but also complicates long-term contract negotiations and quoting for projects.

Beyond pricing, the surge is forcing companies to re-evaluate their entire operational strategy:

Inventory Management: Firms are struggling to balance holding sufficient copper stock against the risk of massive valuation losses should the price correct, or the need to procure at exorbitant rates to meet existing orders.

Alternative Materials (Limited Scope): While some manufacturers explore aluminum as a substitute in specific lower-power applications, aluminum cannot completely replace copper in many high-efficiency or heavy-duty three-phase induction motors without compromising performance standards, such as $IE3$ or $IE4$ efficiency ratings.

Operational Cash Flow: Smaller and medium-sized enterprises (SMEs) are particularly vulnerable, as the higher input costs tie up significantly more working capital, putting a strain on their financial liquidity.

Outlook for Global Trade

The foreign trade outlook remains cautiously challenging. Buyers in crucial markets like Europe and North America are facing delayed investment decisions due to uncertain equipment costs. Motor suppliers are focusing on communicating the necessity of price validity windows and copper surcharge mechanisms in their quotes to protect against further volatility.

Ultimately, the sustained high copper price environment is accelerating a broader industry discussion about hedging strategies, long-term raw material agreements, and the necessity of passing on unavoidable material costs to the end consumer. The industrial world is watching the commodities market closely, hoping for stability that will allow this foundational sector to continue supporting global manufacturing growth without crippling cost burdens.

Post time: Dec-09-2025